State Tax Forms. Earned Income Tax Credit or EITC.

Form 990 is an annual information return required to be filed with the IRS by most organizations exempt from income tax under section 501a and certain political organizations and nonexempt charitable trustsParts I through XII of the form must be completed by all filing organizations and require reporting on the organizations exempt and other activities finances governance.

. Here you will find a collection of state laws passed by the Michigan Legislature and organized by subject area into Chapters Acts and Sections. A In generalThere is hereby imposed on the income of every individual a tax equal to the sum of 1 12 PERCENT BRACKET12 percent of so much of the taxable income as does not exceed the 25-percent bracket threshold amount 2 25 PERCENT BRACKET25 percent of so much of the taxable income as exceeds the 25-percent bracket threshold amount but does not. To make new provision with respect to the persons eligible for appointment as company auditors.

99-841 Tax Reform Act of 1986 - Specifies that the Internal Revenue Code shall be cited as the Internal Revenue Code of 1986 Title I. Welcome to FindLaws hosted version of the Michigan Compiled Laws. Conference report filed in House 09181986 Conference report filed in House H.

This tax credit firsts enacted in the 1970s and expanded many times since then refunds what low- and moderate-income workers pay in Social Security and Medicare taxes with benefits depending on ones income and number of children. An earlier version of this PIIE feature presented a chart on the effect. The up-and-down pattern in 2012-13 may reflect in part decisions by wealthy taxpayers to sell appreciated assets in 2012 in order to pay taxes on those capital gains before income tax rates increased in 2013.

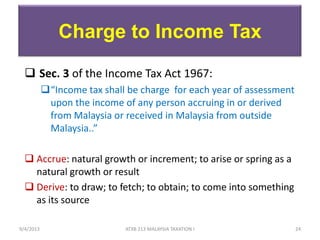

Special relief of RM2000 will be given to tax payers earning on income of up to RM8000 per month aggregate income of up to RM96000 annually. Act to be construed as one with Income Tax Act 1947. After-tax incomes fell sharply at the top of the distribution in 2008 and 2009 but have since partially recovered.

An Act to amend the law relating to company accounts. This relief is applicable for Year Assessment 2013 and 2015 only. Medicare is a government national health insurance program in the United States begun in 1965 under the Social Security Administration SSA and now administered by the Centers for Medicare and Medicaid Services CMS.

Royalties fees or contributions certificate means a certificate issued under section 37. Taxable income 2 The taxable income of a taxpayer for a taxation year is the taxpayers income for. An issuing officer within the meaning of section 3 of the Search and Surveillance Act 2012 may issue a search warrant in relation to a place vehicle or thing on an application made in the manner provided by subpart 3 of Part 4 of that Act by a specified person authorised under subsection 1 if the issuing officer is satisfied that there.

Individual Income Tax Provisions - Subtitle A. PART I Income Tax DIVISION A Liability for Tax. It primarily provides health insurance for Americans aged 65 and older but also for some younger people with disability status as determined by the SSA.

Tax payable by persons resident in Canada 2 1 An income tax shall be paid as required by this Act on the taxable income for each taxation year of every person resident in Canada at any time in the year. Income Tax Act of 1967 Chapter 207. Relief from Income Tax Act 1967.

Increase in Standard Deduction and Personal. Tax Audit Framework On Withholding Tax available in Malay. Business Tax Chapter 209.

Current version as at 01 Jun 2022. Download or print the 2021 Michigan Form MI-1040ES Estimated Individual Income Tax Voucher for FREE from the Michigan Department of Treasury. State Assessment and Equalization.

I 5000 Limited - year of assessment 2014 and. Tax Audit Framework available in Malay version only Superceded by the Tax Audit Framework 01042018 - Refer Year 2018. To amend the Companies Act 1985 and certain other enactments with respect to investigations and powers to obtain information and to confer new powers exercisable to assist overseas regulatory authorities.

19A 20 21 and 22 of the Income Tax Act 1947. So this is the latest version of Form MI-1040ES. Tax Audit Framework available in Malay version only Superceded by the Tax Audit Framework 15122019 - Refer Year 2019.

Basic Concepts Of Income Tax Exemptions Deductions Jupiter

Pdf Income Tax Law Simplification And Tax Compliance A Case Of Medium Taxpayers In Zanzibar

Chapter 5 Non Business Income Students

Ay 2022 23 Depreciation Rate Chart As Per Income Tax Act 1961 Income Tax Taxact Tax

General Deductions Of Expenditure Under Section 37 1

Hhqfacts Perquisites From Employment Case Facts By Hhq Law Firm In Kl Malaysia

Wolters Kluwer Malaysia Cch Books Malaysia Income Tax Act 9th Ed

Revisiting The Case Of Customary International Tax Law In International Community Law Review Volume 23 Issue 1 2021

Chapter 6 Business Income Students 1

Pdf Income Tax Law Simplification And Tax Compliance A Case Of Medium Taxpayers In Zanzibar

Top Quality Payroll And Tax Services In Belgium Tax Services Payroll Financial